Angela Hattery, PhD

Professor of Women and Gender Studies at the University of Delaware

Women who have recently graduated from college face many challenges on their pathway to financial independence. I want to highlight three of the most important: Student debt, caregiving responsibilities and the gender wage gap.

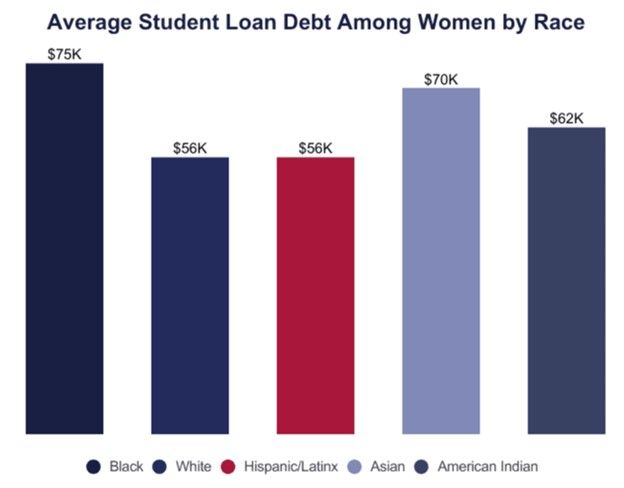

- Student debt: According to the Education Data Initiative, women have significantly more student loan debt than men. Most (64%) of all student loan debt belongs to women; their average loan debt upon graduation is $31,726. Women’s average monthly student debt repayment is $307. And total debt and monthly repayments are higher for non-white women.

- Caregiving responsibilities: As my own research has documented, despite women now comprising nearly half (47%) of the labor market, they continue to shoulder the bulk of caregiving responsibilities, including for children and aging parents. According to the Institute for Women’s Policy Research, 4.8 million women (26% of all undergraduate students) are raising dependent children and 43% of these women (2 million students) are single parents. Women’s caregiving responsibilities are not simply financial. They also involve significant amounts of time, which may result in them choosing jobs with more flexible work patterns, working fewer hours, and taking time out of paid employment when they add new members to their families. Thus, caregiving responsibilities, both current and in the near future, shape women’s employment options after college in challenging and important ways.

- The gender wage gap is persistent: Today, women earn, on average, 80% of what men earn, but this figure hides the realities of the gender wage gap, largely because it includes data on men and women working minimum wage jobs, where all employees are making the minimum wage. A more complex picture emerges when we add other factors to the mix, including race and education. Black women earn only 70% of what white men earn, and Hispanic women earn even less, 65%. Upon graduation from college, according to the Education Data Initiative, women earn a median annual salary of $56,170, 26% of what men earn. As noted above, the reasons for this include the kinds of work women do (work with flexible schedules, part-time work). Though standard gender wage discrimination still occurs — women being paid less for the same job as men, something I’ve experienced myself — the majority of the wage gap can be explained by the fact that the labor market is highly segregated by gender: men and women do different jobs. And the jobs men do do pay more. Sometimes, this is because women choose jobs that allow them to meet their caregiving responsibilities.

How can young women best set themselves up for a fruitful financial life that takes them from the post-college stage through to retirement?

As noted in the previous section, women face several additional challenges to their financial success that include higher student loan debt, greater caregiving responsibilities that often shape their career and job choices and the persistent gender wage gap. There is no easy solution to these challenges, and every woman has to make decisions that align with her values. That being said, by thinking outside the box and carefully preparing, women can mitigate these challenges and set themselves up for financial success in retirement. Here’s why it matters: Women, on average, regardless of race, can expect to live longer. And, in their later years, they can expect to continue to have caregiving responsibilities for aging spouses and partners, and many for children and grandchildren as well. So, women must be prepared. Here are a few tips:

- Consider the labor market: While in college and even high school, do some research on the trends in the labor market and the wages associated with different kinds of professions. For example, health care and technology are both booming, both pay relatively well, and both can have flexible work schedules that will allow for managing employment and caregiving. Think outside the box and consider doing something new. You may not see a lot of women working in these kinds of jobs, but don’t be discouraged. Be a trailblazer! Seek out role models if you can. Most women in these fields will be happy to share tips and encouragement. They want to see more women in these workplaces, too!

- Minimize student loan debt: Many states offer free or low-cost tuition for community colleges, allowing you to get a jump start on that college education at a very low or even no cost. Taking advantage of these programs and then transferring to a four-year college or university can cut your tuition and student loan debt by half. If you must take student loans, take the extra time to educate yourself about the difference in loans. It may take longer to get a subsidized, low-interest loan than an unsubsidized loan from a bank or predatory lender. Still, the time and effort will pay off in lower interest rates, lower overall debt, and lower monthly payments. If you can, make more than the minimum payment and pay off those loans early. This can save you thousands of dollars in interest.

- Take a salary negotiation workshop: Though many factors contribute to the gender wage gap, women are less likely to negotiate than men, especially when they first enter the labor market. Many organizations, including the American Association of University Women (AAUW), offer salary negotiation workshops. Check if your campus has an AAUW chapter; you can take the workshop for free!

- Save for retirement: You will live longer and have greater caregiving responsibilities, which may result in you retiring earlier than men. Thus, you will need more money. The only way you can prepare for this stage in your life is to save for retirement. You must start saving immediately, from your first paycheck. Take a short course on compound income. You’ll learn that the earlier you start saving, the faster your money will grow on its own! Strive to maximize the annual allowance in a 401(K). If your employer contributes or matches your 401(K) contributions, you absolutely must contribute the maximum; otherwise, you are leaving their money on the table, not just your own! Find a good investment counselor and tax consultant so that you can learn about the smartest ways to invest that take advantage of existing tax laws. And when it’s time to retire, do the same. Not all the money saved for retirement is the same, be smart about which money you tap into first and for what expenses. You will need every dollar, so don’t pay more in taxes than you owe.

Resources for Building Your Finances As a Woman

Starting a path toward financial independence once you’ve left college can seem intimidating. But there are plenty of resources that can help you navigate the terrain. Here are some of the resources that can help:

Financial Assistance Programs

- AAUW: The American Association of University Women offers a substantial range of career development grants.

- Department of Education and Cultural Affairs: This government department awards grants to support academic, cultural and professional goals.

- GIRLBOSS Foundation Grant: This grant is awarded twice a year to female and female-identifying entrepreneurs in design, fashion, music and the arts who work in creative fields.

Career Advancement Programs and Services

- Women Employed: Non-traditional students can find the help they need to succeed in their education and career goals through Women Employed programs, which are designed to bridge gaps in knowledge and skills.

- Women In Data: This membership-based community seeks to close the gender gap and increase diversity in data careers by providing awareness, education and advancement to women in the tech industry.

- Sisterhood Agenda: For the past 25 years, this group of women has been educating, empowering and supporting women around the world with their mentorship programs and partnerships.

Female Empowerment Programs

- Department of Education and Cultural Affairs: This US department provides resources on its site to uplift women in areas of education and career opportunities.

- USAID: You’ll find a number of resources on gender equality and women’s empowerment through the development agency’s online platforms.

- Women’s Empowerment: This initiative was founded to help women who find themselves homeless or living in poverty, with programs, services and resources.

Advocacy Organizations and Support Groups

- Lean In: If you’re looking for a space to connect with other women or with your women co-workers, this is a group that helps facilitate that.

- Authentic Connections: This organization runs groups that help participants develop strong, supportive relationships to increase their well-being and resilience.

- Mayo Clinic: Most universities offer support groups for female students and graduates, but if you’re still struggling to find one, the Mayo Clinic can help link you up with like-minded women.